Open Banking & Smart Data Analytics

Unlock the real power of transactional data — with AI-driven insights, categorisation and decisioning.

We’re trusted by many companies

SERVICES

Why Open Banking matters. beyond connectivity.

Open Banking opens a door — not just to account data, but to intelligence.

At FastDox, we don’t just pull in financial feeds — we understand them. We structure, analyse, compare, flag and feed them into decision logic.

That makes Open Banking a critical pillar in transformations for financial institutions, legal firms, debt managers and more.

More accurate affordability

Decisions backed by actual, structured client data.

Fewer manual reviews

Only exceptions need human attention.

Better risk detection

Anomalies, cash flow issues flagged early.

Faster client decisions

Less waiting, more automated turnaround.

Actionable insights

For your team, your clients, your reporting.

Auditability & compliance

Every consent, transaction read, categorisation and decision is logged and traceable.

Solutions

What FastDox brings to Open Banking

You don’t just get bank feeds — you get actionable intelligence fully woven into your business logic.

AI-powered transaction reading & classification

Automatically categorises income, expense, transfers, merchant codes etc. — turning raw data into structured, usable insight.

Comparative & historical analytics

Compare month-to-month spending, detect anomalies, trends, cash flow forecasts & stress signals.

Risk and pattern detection

Use AI to flag unusual transaction patterns, overdrafts, sudden drops or spikes, or mismatches to declared income.

Decision rule integration

Feed Open Banking metrics and insights into your workflows (eligibility checks, scoring, routing).

Visual reports & dashboards

Present clean, interactive charts — by category, period, client segment — for rapid review.

Seamless automation

Trigger next steps: follow-ups, document requests, escalations, or human review — all based on financial insights.

Secure, compliant connectivity

Open Banking APIs with secure flows, consent, encryption, and audit trails built in.

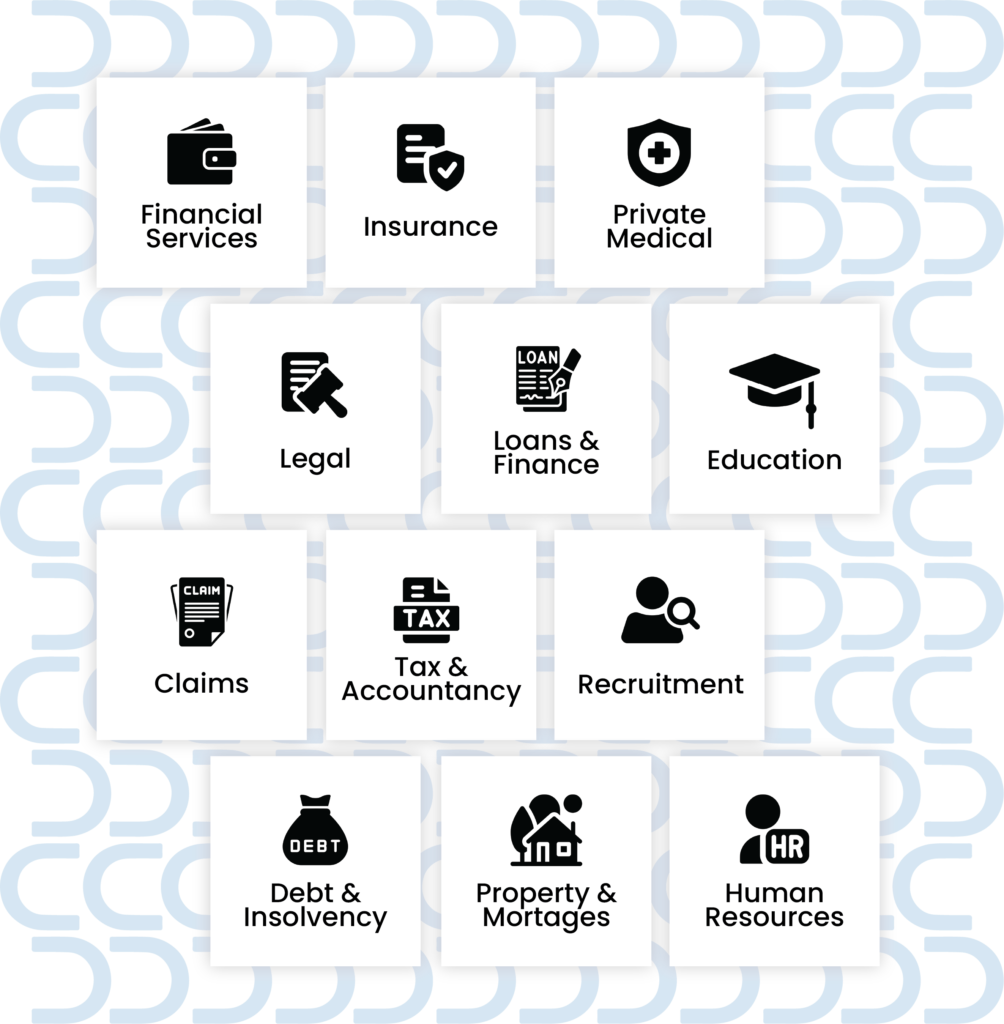

Sector-aligned use cases

Tailored for debt recovery, legal, financial underwriting, client affordability assessment, AML/KYC support, and more.

Sectors We Serve

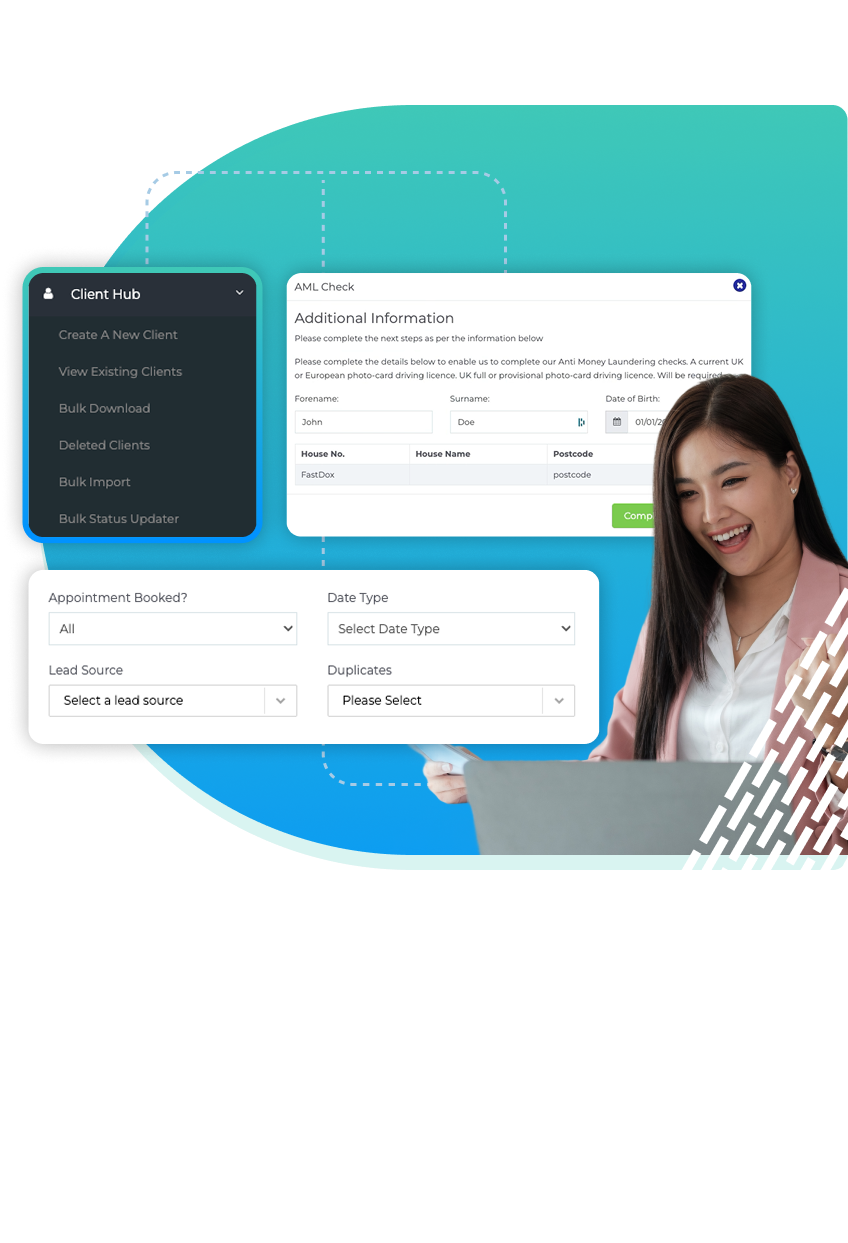

FastDox.

An all-in-one platform.

Our all-in-one platform combines the power of 20 products into one customisable and brandable system.

We have helped businesses consolidate multiple cumbersome existing individual products into one centralised and succinct solution whilst streamlining processes, improving efficiency, reducing costs, and increasing conversions.

Let’s bring your financial data to life.

Let us show how FastDox transforms open banking from mere connection into business intelligence.

How does it work?

We're trusted by 100's of companies to

accelerate their business growth

1

Book a live

demonstration

Speak with one of our team and understand why FastDox is right for you and your business.

2

We’ll start the

onboarding

process

We’ll start building out

your software to your exacting specifications.

3

Move your new software

to a live environment

You’ll start benefiting straight away from our advanced CRM software.

Integration options to move

your data between web apps

- Use our API or powerful webhooks to link FastDox with many popular tools and services

- Receive leads directly from lead providers

- Connect seamlessly with 3,000+ external web apps and automate workflows between them with our Zapier integration

- Integrate with your external calendars

Other companies have already made the

switch to FastDox, why not join them?

FastDox is helping teams just like yours to manage

their leads and close more deals.

Just request a demo to get started.

- FastDox are committed to protecting your privacy