Mortgage & Lending CRM

Modern mortgage operations powered by AI, automation, and seamless client journeys.

We’re trusted by many companies

Why mortgage lenders need FastDox

Mortgage origination and servicing is complex — credit checks, affordability, identity verification, document gathering, underwriting, regulatory compliance, and client communications all must align. Legacy systems, manual handoffs, and siloed tools slow you down and risk losing applicants along the way.

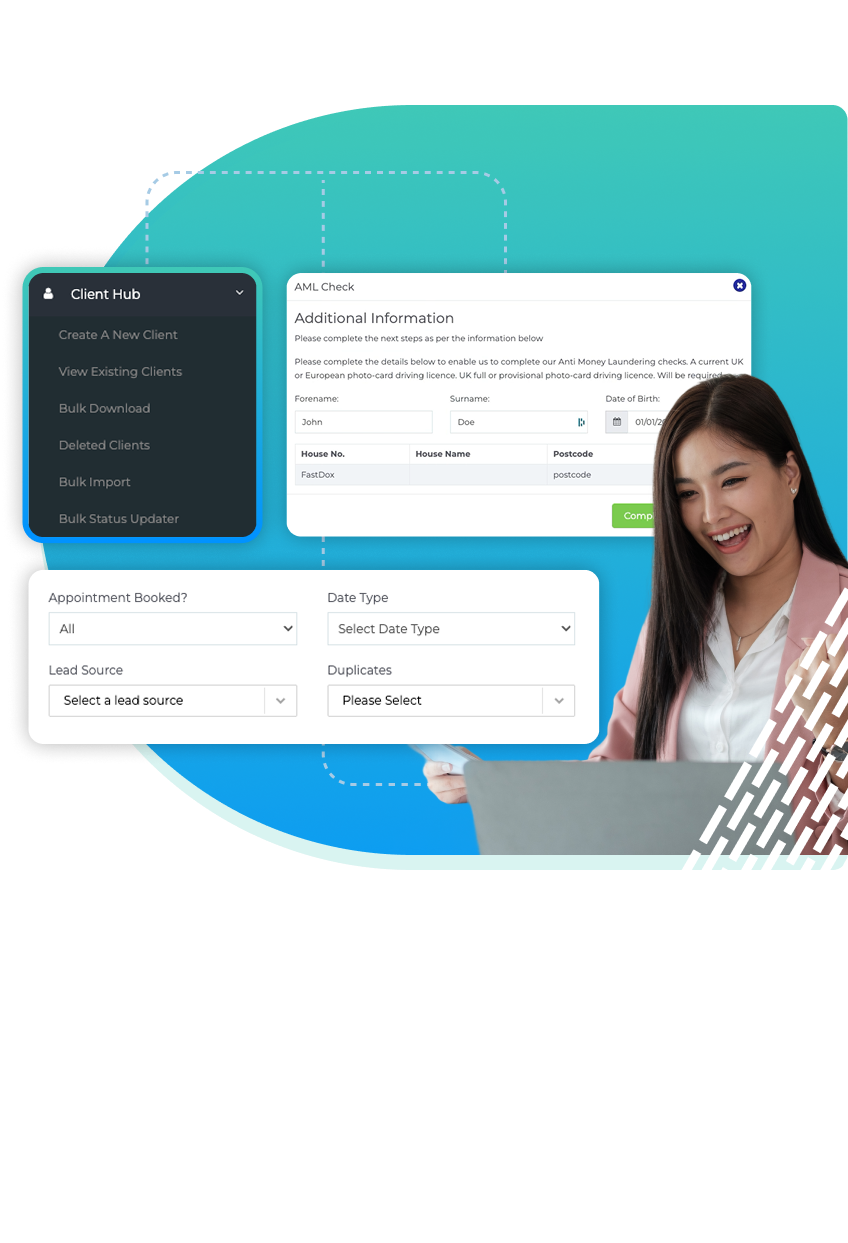

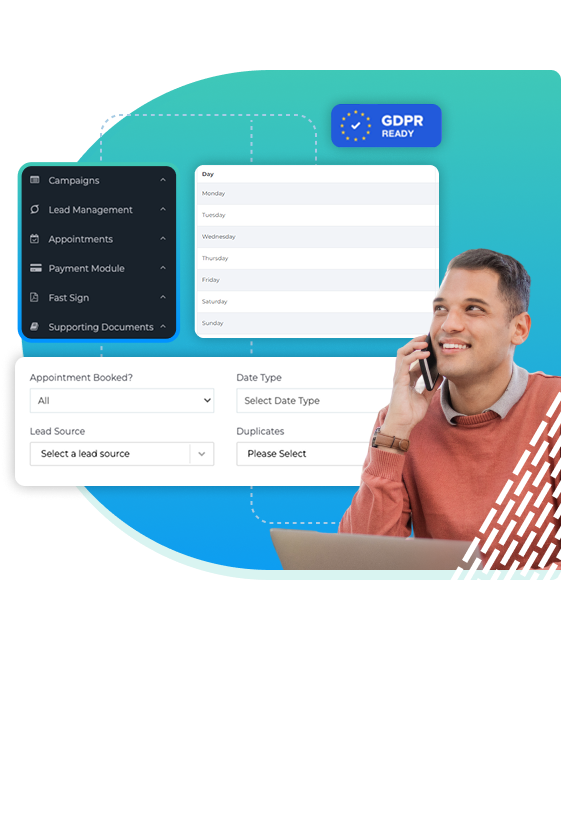

FastDox offers a unified operational engine built for mortgage workflows. We embed AI document verification, OCR, lead routing, compliance checks, onboarding, e-signatures, engagement, and reporting — all inside one continuous experience. You deliver faster decisions, reduce risk, and provide clients a frictionless journey.

What is a Mortgage CRM?

Mortgage CRM (customer relationship management) cuts through the endless clutter of paperwork and leverages the benefit of cloud based solutions to provide exceptional service.

Mortgage professionals win thanks to one software solution where they can access their client data and create personalised solutions for every client.

Thanks to easy cloud based storage, you can boost mortgage products and enhance decisioning processes.

SERVICES

Why mortgage firms choose FastDox

Speed & conversion

Reduce friction, complete more applications.

Risk & compliance

Identity, document, fraud checks built in.

Operational efficiency

Automation frees your team to focus on exceptions.

Transparency with stakeholders

Funders and insurers see real-time data.

Scalable platform

Grow volume without multiplying staff.

Consumer experience

Clients enjoy clear status, minimal friction, mobile access.

Key modules & capabilities for mortgage operations

Lead Capture & AI Agent Onboarding

Guide prospects through data collection, preliminary qualification, and document upload via virtual assistant.

ID Verification & Document Verification

Validate identity documents (IDs, passports), proof of address, bank statements automatically.

AI OCR & Extraction

Parse financial statements, payslips, tax returns, contracts; classify and highlight anomalies.

Open Banking Integration

Retrieve client bank feeds securely to assess income, expenses, affordability in real time.

AML / KYC / KYB & Fraud Checks

Run compliance and fraud screening at early stages.

Lead Management & Skill-Based Routing

Assign deals or applications to the right team (residential, commercial, specialist), region or underwriter.

Workflow Automation & Decision Logic

Automate underwriting steps, exception paths, rule-based routing, approval logic, and escalations.

Next-Generation E-Sign (PKI)

Clients sign loan documents, disclosures, and agreements inside your branded flow.

Re-Engagement AI

Reconnect applicants who pause or abandon mid-process, driving higher completion rates.

Appointment Scheduling (Teams / Zoom)

Allow clients to schedule calls, valuations, or underwriting reviews inline.

Client / Applicant Portal

Branded interface where clients check status, upload additional documents, message support, and view offers.

Reporting & Analytics

Track application volumes, conversion, KPIs, underwriting bottlenecks, drop-offs and risk metrics.

Funder / Stakeholder Portal

Provide lenders, mortgage insurers or partners with real-time access to application pipelines, approval status, and performance dashboards.

Elevate your mortgage operations

With a platform built for speed, insight, automation and transparency.

Let’s show you how FastDox can transform your lending funnel into a powerful, intelligent experience.

Reimagining: the mortgage process

FastDox ensures that mortgage and loan agents enjoy a fully integrated experience where they can manage anything from loan origination to automated marketing in one place.

Our online sources allow you to easily check balances and bank accounts, dial leads, and manage the document exchange process.

Automating credit origination

from one platform

Mortgage CRM software enables lenders to facilitate several loan origination processes. These include collating client data to check for prequalification of loans, as well as seamless client communication throughout the whole process.

Loan origination software makes it easy to deliver a high level of client service as it helps users with every step of the advice process and beyond.

FAQ’s

Read our list of frequently asked questions to get the answers you’re looking for.

If you still need more information,

please give us a call at 0161 820 9313

What is mortgage CRM?

Mortgage CRM (customer relationship management) allows you to manage every facet of your business, from communication with clients and loan offices to assisting borrowers with loan origination to processes to authenticate accounts.

How can your CRM software enhance my business offering?

Can I access mortgage CRM on any device?

Can I do live conversations via this software?

Can I personalise your mortgage software according to my clients' needs?

I am not quite tech savvy - will it be easy for me to master the mortgage CRM process?

What is the price of your mortgage CRM software application?

How does it work?

We're trusted by 100's of companies to

accelerate their business growth

1

Book a live

demonstration

Speak with one of our team and understand why FastDox is right for you and your business.

2

We’ll start the

onboarding

process

We’ll start building out

your software to your exacting specifications.

3

Move your new software

to a live environment

You’ll start benefiting straight away from our advanced CRM software.

Integration options to move

your data between web apps

- Use our API or powerful webhooks to link FastDox with many popular tools and services

- Receive leads directly from lead providers

- Connect seamlessly with 3,000+ external web apps and automate workflows between them with our Zapier integration

- Integrate with your external calendars

Other companies have already made the

switch to FastDox, why not join them?

FastDox is helping teams just like yours to manage

their leads and close more deals.

Just request a demo to get started.

- FastDox are committed to protecting your privacy