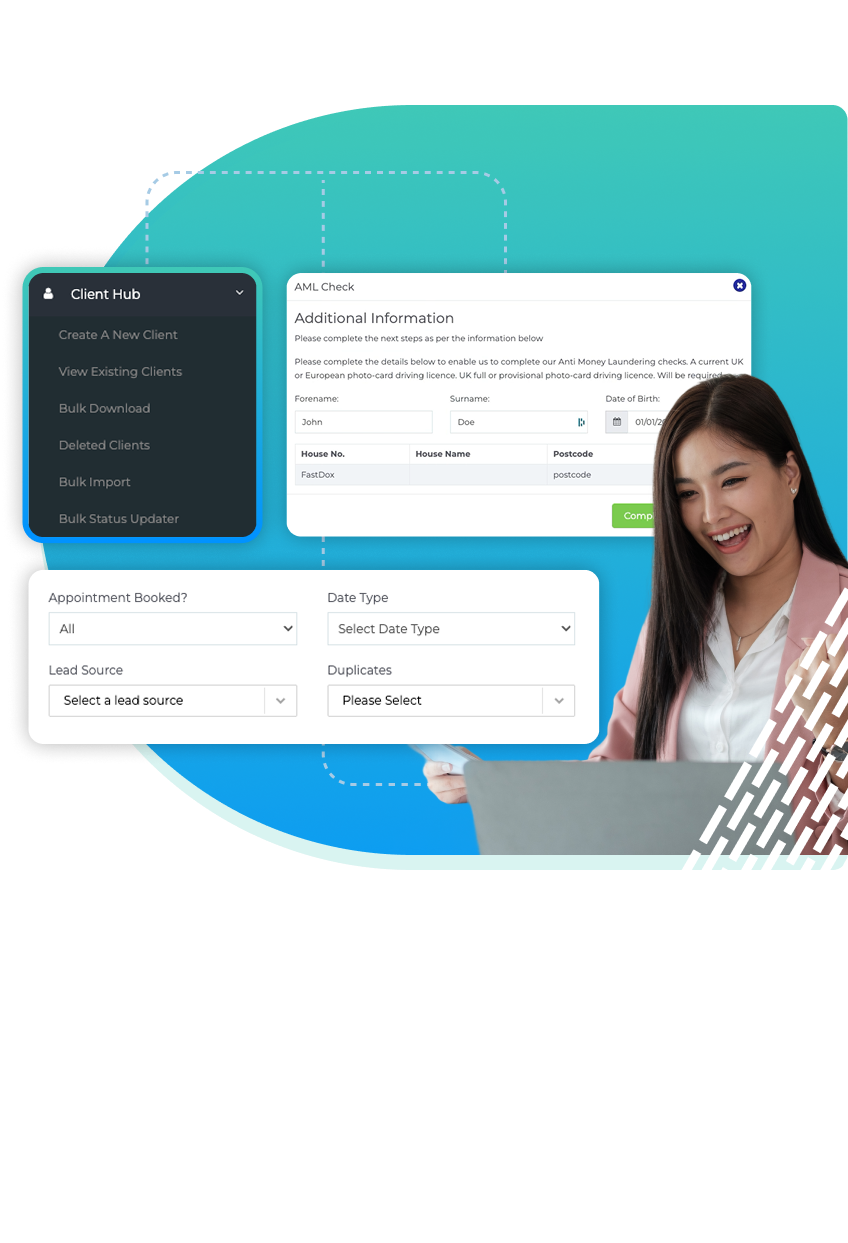

A Loan CRM with all

you need in one application

At FastDox, we provide cutting-edge solutions that are designed to integrate seamlessly

into your existing infrastructure, offering you the best of both worlds.

We’re trusted by many companies

Loan CRM Software Solutions

The digital era has redefined the boundaries of many industries, none more so than the Loans & Finance sector.

Today, we stand on the cusp of a digital renaissance, where technology offers limitless possibilities for innovation, efficiency, and customer satisfaction.

Digital transformation in the Loans & Finance sector is not a futuristic concept but a present-day necessity.

The benefits are vast and the risks of not adapting are severe.

Companies aiming to capture a share of tomorrow’s market must invest in digital transformation today.

FastDox can transform your business today, so why wait – contact us today to get started!

Why choose our CRM: for Loan & Financial Services?

SERVICES

Why choose our CRM for Loan Services?

Easy Document Management

Our cloud based solution does away with endless piles of paperwork.

It enhances overall efficiency and productivity and gives you the convenience of a fully online experience.

All data is protected and easy to access and modify wherever you are.

Loan Origination

Brokers can easily review and approve loan applications from borrowers with our recognized loan origination system.

Every part of the mortgage process throughout, from applying to closing, is seamlessly managed with our mortgage CRM.

Mortgage Automator

Our end-to-end solution provides an ideal solution for residential lenders and commercial clients.

Payments and document management are all handled from one easy-to-access platform.

Effortless Reporting

Our cloud based system makes reporting and reviewing analytics easy.

With one single login, brokers and lenders can track performance and client satisfaction, improving the overall experience of the full mortgage experience.

Key features and benefits for Loan Companies

Self-Service Journeys

Our automation allows financial service providers to offer self-service onboarding, enabling clients to complete, application forms, document collection, KYC, AML, ID Verification, Open Banking & Credit Checking all within one simple customer portal at a time convenient to them, freeing up human resources for more complex issues and enhancing the customer experience.

Quick Decision-making

Our enhanced data analytics and AI-driven tools provide actionable insights real-time, aiding in more informed and timely decision-making.

Automated Compliance Checks

Keeping up-to-date with ever-changing financial regulations is a monumental task. Our automation tools can help by ensuring compliance is maintained in real-time and never missed. Whether that be KYC/KYB, AML or ID Verification. All can be enabled and automated within the FastDox platform.

Automated Workflows

We understand that financial firms onboarding often involves complex, multi-step tasks like loan approval, risk assessment, and compliance checks. Our automation and digital transformation can simplify this complexity into streamlined automated workflows.

Improved Security

Advanced security protocols like encryption and multi-factor authentication can be more easily implemented and maintained within the FastDox platform.

Document & Data Collection

Not only can the FastDox platform collect any form of documentation or data from your clients whilst simultaneously completing in-depth due diligence, and document signing. It can also distribute this data to clients via our customer portals, and communication platform or push this data to third parties via our extensive APIs and Webhooks.

Automated Financial Reviews

If regular contact with a client is required, then FastDox’s automated financial reviews can be configured with ease, scheduling regular check points with your client base, determining financial circumstances and dynamically building tailored journeys based on the information provided.

Reduced Operational Costs

The FastDox platforms, digital tools help in reducing the cost of many operations by eliminating manual processes, which in turn decreases the likelihood of human error.

Risk Assessment

Our AI and machine learning tools can analyse more variables than humanly possible when assessing risk, ensuring a more comprehensive review.

Reimagining: the loan & finance process

FastDox ensures that mortgage and loan agents enjoy a fully integrated experience where they can manage anything from loan origination to automated marketing in one place.

Our online sources allow you to easily check balances and bank

accounts, dial leads, and manage the document exchange process.

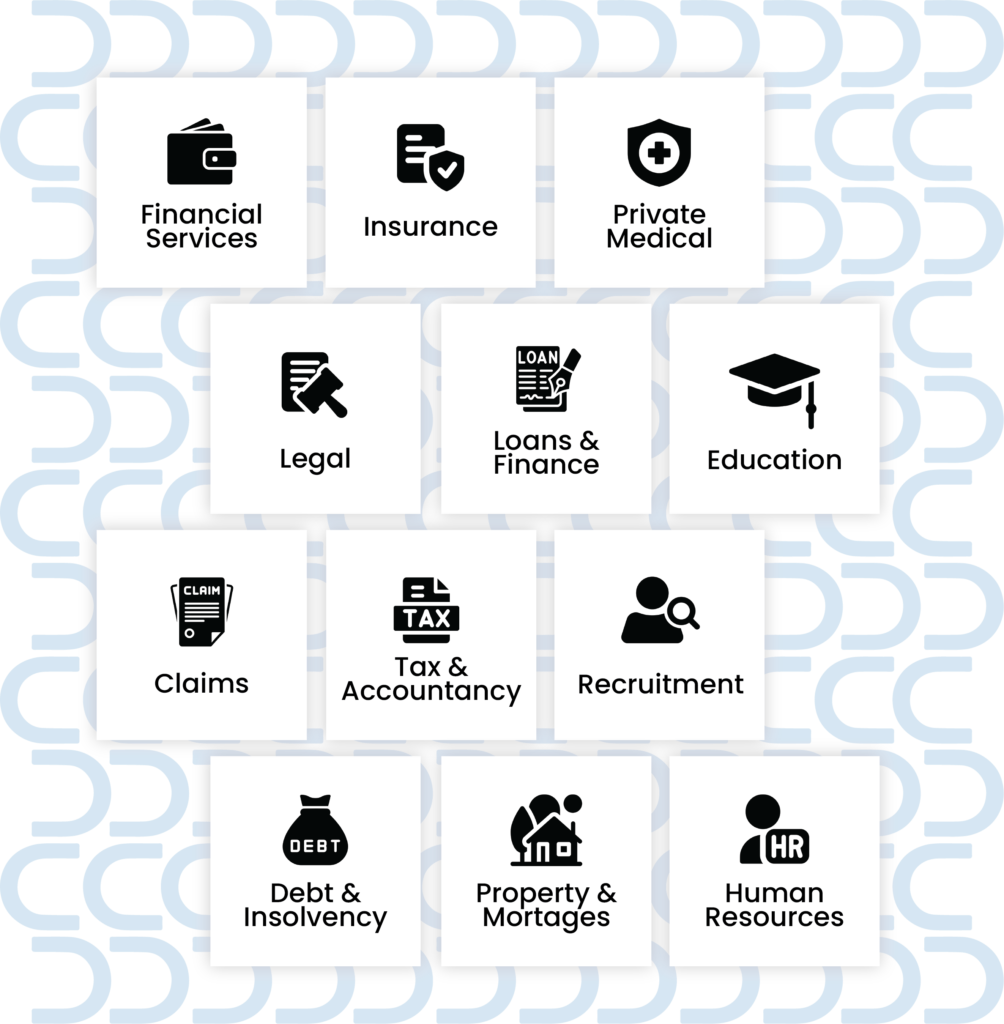

Sectors We Serve

FastDox.

An all-in-one platform.

Our all-in-one platform combines the power of 20 products into one customisable and brandable system.

We have helped businesses consolidate multiple cumbersome existing individual products into one centralised and succinct solution whilst streamlining processes, improving efficiency, reducing costs, and increasing conversions.

How does it work?

We're trusted by 100's of companies to

accelerate their business growth

1

Book a live

demonstration

Speak with one of our team and understand why FastDox is right for you and your business.

2

We’ll start the

onboarding

process

We’ll start building out

your software to your exacting specifications.

3

Move your new software

to a live environment

You’ll start benefiting straight away from our advanced CRM software.

Digital Onboarding. Try it for yourself.

Integration options to move

your data between web apps

- Use our API or powerful webhooks to link FastDox with many popular tools and services

- Receive leads directly from lead providers

- Connect seamlessly with 3,000+ external web apps and automate workflows between them with our Zapier integration

- Integrate with your external calendars

Other companies have already made the

switch to FastDox, why not join them?

FastDox is helping teams just like yours to manage

their leads and close more deals.

Just request a demo to get started.

- FastDox are committed to protecting your privacy