Debt & Insolvency CRM

Accelerate recovery, reduce risk, and deliver clarity with AI-powered debt management solutions.

We’re trusted by many companies

Why debt and insolvency firms

need smarter automation

Debt collection and insolvency management is high-stakes, time-sensitive, and heavily regulated.

Late, inefficient processes, manual reviews, and poor debtor experience can erode recoveries, increase legal risk, and damage reputation.

FastDox bridges those gaps.

We offer an integrated platform built for debt and insolvency operations — automating income and expenditure reviews, verifying identities, managing compliance, guiding debtor engagement, and delivering intelligent workflows — all in one continuous, branded journey.

SERVICES

Why debt & insolvency firms choose FastDox

Precision & insight

AI-derived financial profiles guide your recovery decisions.

Speed & scale

Process more cases faster, with fewer staff.

Continuous engagement

Re-engagement avoids stalled accounts

Transparency & trust

Portal and APIs allow all parties to stay informed

Compliance & audit assurance

KYC, AML, e-sign, logging built in.

One unified platform

No data silos, no broken tools, just streamlined recovery.

Reimagining: the debt insolvency process

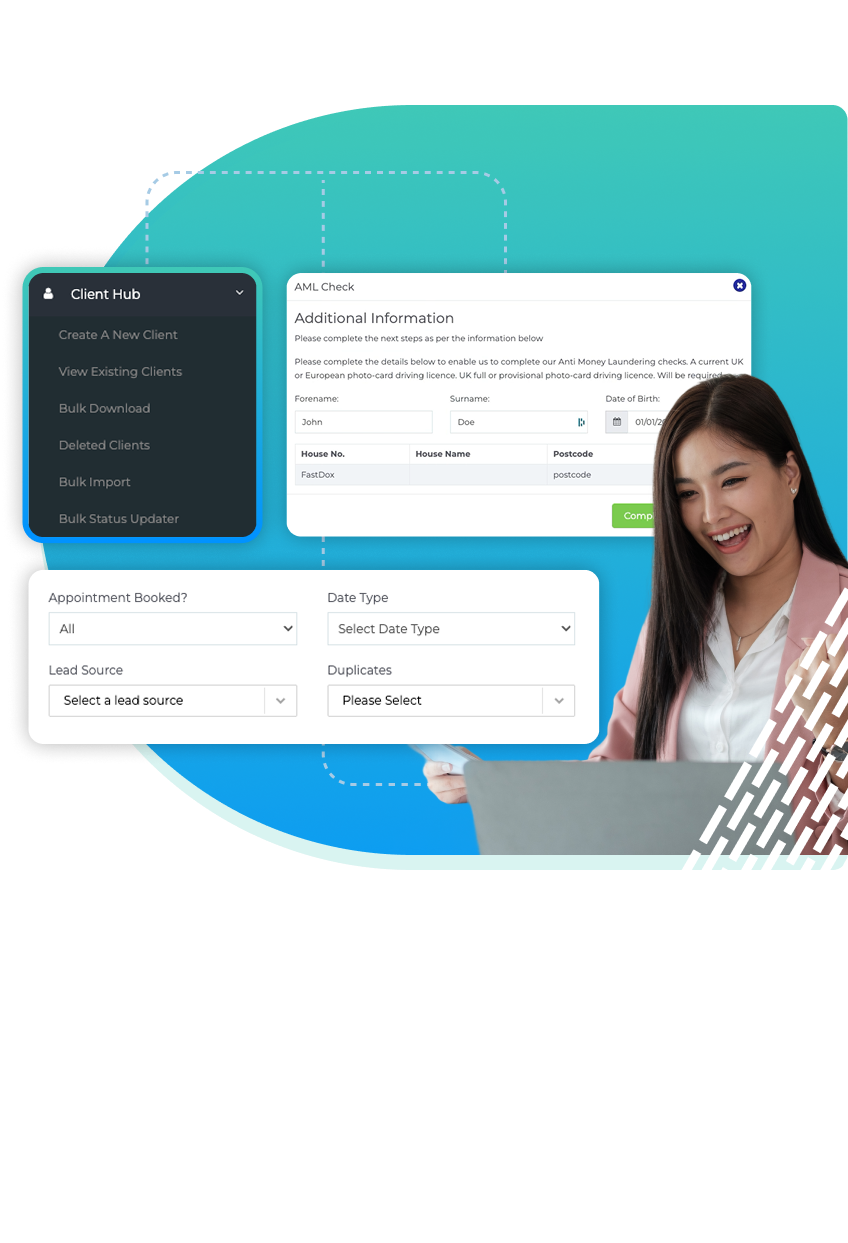

FastDox ensures that mortgage and loan agents enjoy a fully integrated experience where they can manage anything from loan origination to automated marketing in one place.

Our online sources allow you to easily check balances and bank

accounts, dial leads, and manage the document exchange process.

WHY CHOOSE FASTDOX?

Key modules & capabilities for debt & insolvency

Debt & Insolvency are complex industries.

Our claim CRM provides an all-in-one soluton with several benefits for your firm.

Automated AI Income & Expenditure Reviews

Upload bank statements or transaction data; AI categorises income, expenses, liabilities, and flags anomalies.

Digital Onboarding & AI Agents

Debtors are guided through intake, affordability checks, and engagement using conversational AI.

ID Verification + AI Document Verification

Validate debtor documents (IDs, proofs, payslips) using AI and cross-checks (DVLA, Companies House, etc.).

AML / KYC / Multi-Bureau Checks

Screen debtors for fraud risk or compliance exposure via bureau data and sanction lists.

Workflow Automation & Case Workflows

Automate case stages: review, negotiation, payment scheduling, legal actions, and escalations.

Lead Management & Re-Engagement

Re-engage debtors who stall in the process, prompt for missing data, and maintain momentum.

Case Hub / Portal

Provide debtors with a secure portal to view status, submit evidence, propose payments — supported by AI agents 24/7.

Lender / Creditor Communication

Automatically update lenders or creditors with case status, settlement proposals, or deviations from plan.

Next-Generation E-Sign (PKI compliant)

Collect signatures for agreements, repayment plans or notices within your flow.

Reporting & Analytics

Monitor portfolio performance, case aging, default risk, income shortfalls, and team KPIs.

Integration & Data Enrichment

Connect to Open Banking, company registries, credit bureaus, CRMs, case systems, and APIs.

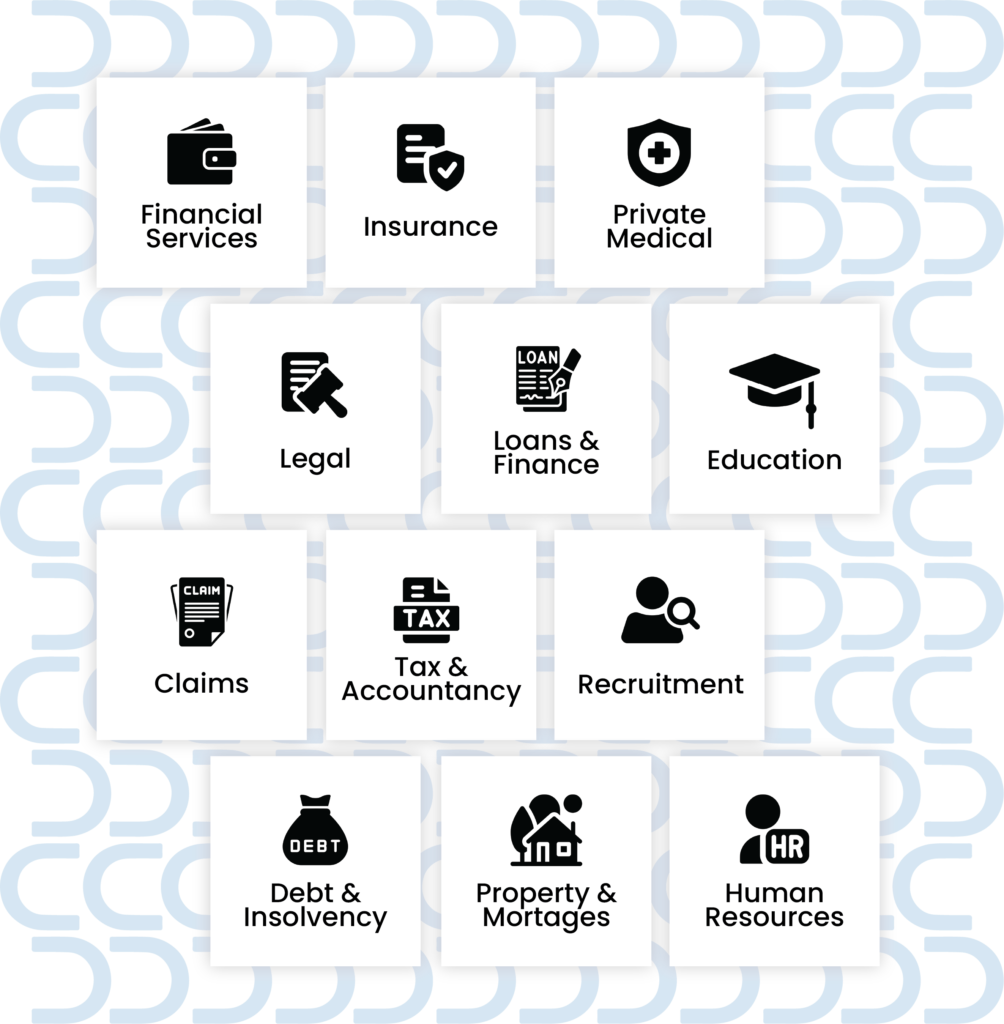

Sectors We Serve

FastDox.

An all-in-one platform.

Our all-in-one platform combines the power of 20 products into one customisable and brandable system.

We have helped businesses consolidate multiple cumbersome existing individual products into one centralised and succinct solution whilst streamlining processes, improving efficiency, reducing costs, and increasing conversions.

How does it work?

We're trusted by 100's of companies to

accelerate their business growth

1

Book a live

demonstration

Speak with one of our team and understand why FastDox is right for you and your business.

2

We’ll start the

onboarding

process

We’ll start building out

your software to your exacting specifications.

3

Move your new software

to a live environment

You’ll start benefiting straight away from our advanced CRM software.

Integration options to move

your data between web apps

- Use our API or powerful webhooks to link FastDox with many popular tools and services

- Receive leads directly from lead providers

- Connect seamlessly with 3,000+ external web apps and automate workflows between them with our Zapier integration

- Integrate with your external calendars

Transform your debt recovery process today.

from first contact to settlement. within one intelligent, scalable system.

Let FastDox show you automated affordability, continuous workflows, and better recoveries.

Just request a demo to get started.

- FastDox are committed to protecting your privacy