Financial Services CRM

Accelerate growth, reduce risk, and deliver world-class client experiences with intelligent automation.

We’re trusted by many companies

Powering transformation across modern financial operations

Banks, lenders, wealth managers, and fintechs are under constant pressure to onboard faster, stay compliant, and create seamless digital journeys that still meet strict regulatory standards.

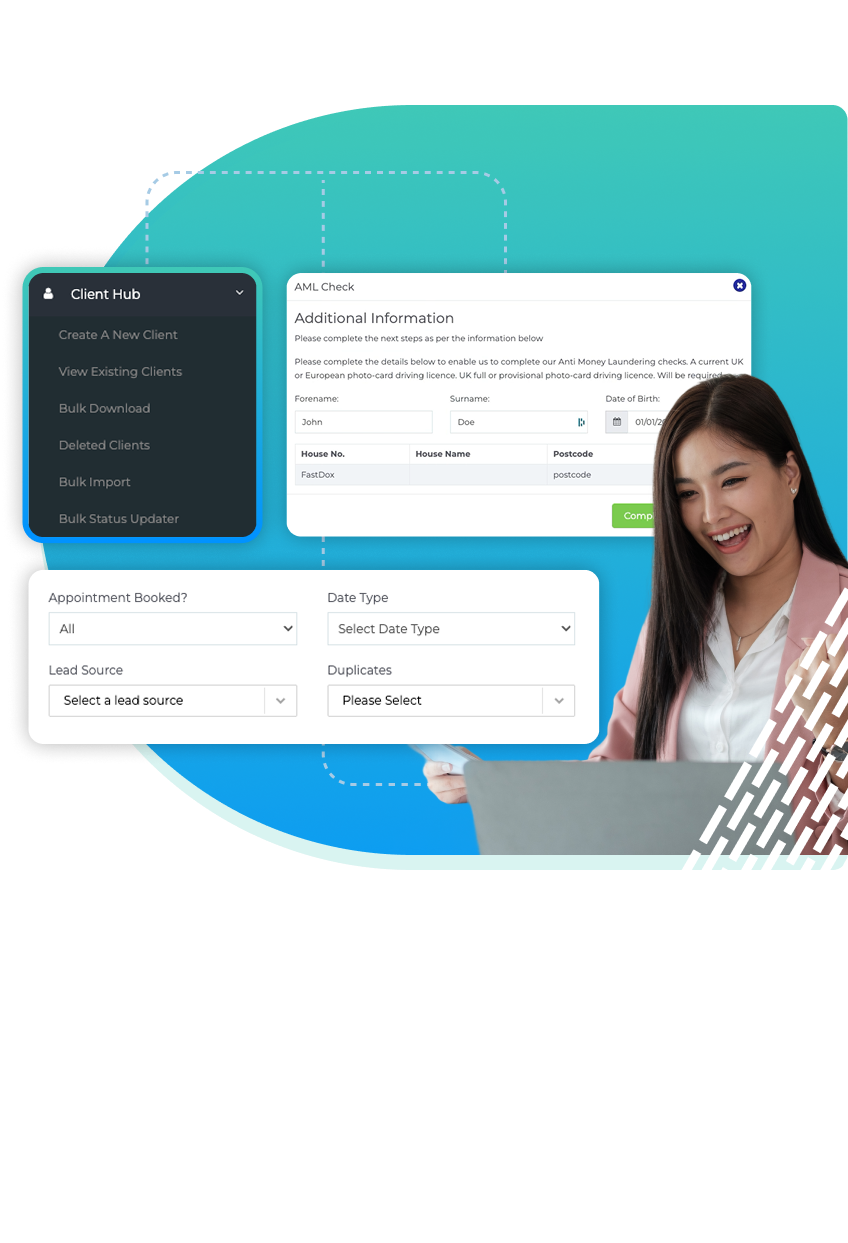

FastDox provides an end-to-end intelligent automation platform designed specifically for financial services.

Our technology unifies onboarding, verification, document processing, e-signing, compliance checks, lead management, scheduling, and reporting — all inside one continuous, branded journey.

From AI document verification to Open Banking integrations and PKI-compliant digital signing, FastDox gives your clients a frictionless experience and your teams the speed, accuracy, and assurance they need.

SERVICES

Why choose our CRM for Financial Services?

Speed

Instant, AI-powered processes replacing manual lag.

Compliance

PKI signing, AML/KYC/KYB, and full audit logs.

Efficiency

Automated document handling and routing.

Engagement

Integrated AI Agents, re-engagement, and scheduling.

Scalability

Global time-zone coverage and multi-language readiness.

Trust

Secure, branded experiences from first contact to approval.

Start your transformation

Empower your financial operations with automation, intelligence, and seamless customer experiences.

FastDox combines AI, compliance automation, and embedded workflows to help you deliver faster decisions, safer onboarding, and better client outcomes — globally, in real time.

Key features and benefits for financial services

Digital Onboarding & AI Agents

Fully guided self-service onboarding, available 24/7, supported by AI-powered customer assistants.

ID Verification & AML Compliance

Instantly verify clients with document, biometric, and sanctions checks.

AI OCR & Automation

Extract, classify, and analyse documents such as statements, contracts, or payslips in seconds.

Open Banking Integration

Securely connect client bank feeds to verify income, affordability, and financial stability.

Lead Management & Skill-Based Routing

Route cases dynamically to the right team based on product type, geography, or workload.

Next-Generation E-Sign (PKI)

Legally binding, PKI-secured signatures directly in your workflows.

AI Re-Engagement

Automatically follow up with stalled applicants to reduce drop-off rates.

Appointment Scheduling (Teams / Zoom)

Enable clients to book calls or reviews directly within your digital journey.

Reporting & Dashboards

Real-time insights into conversion, risk, and performance metrics.

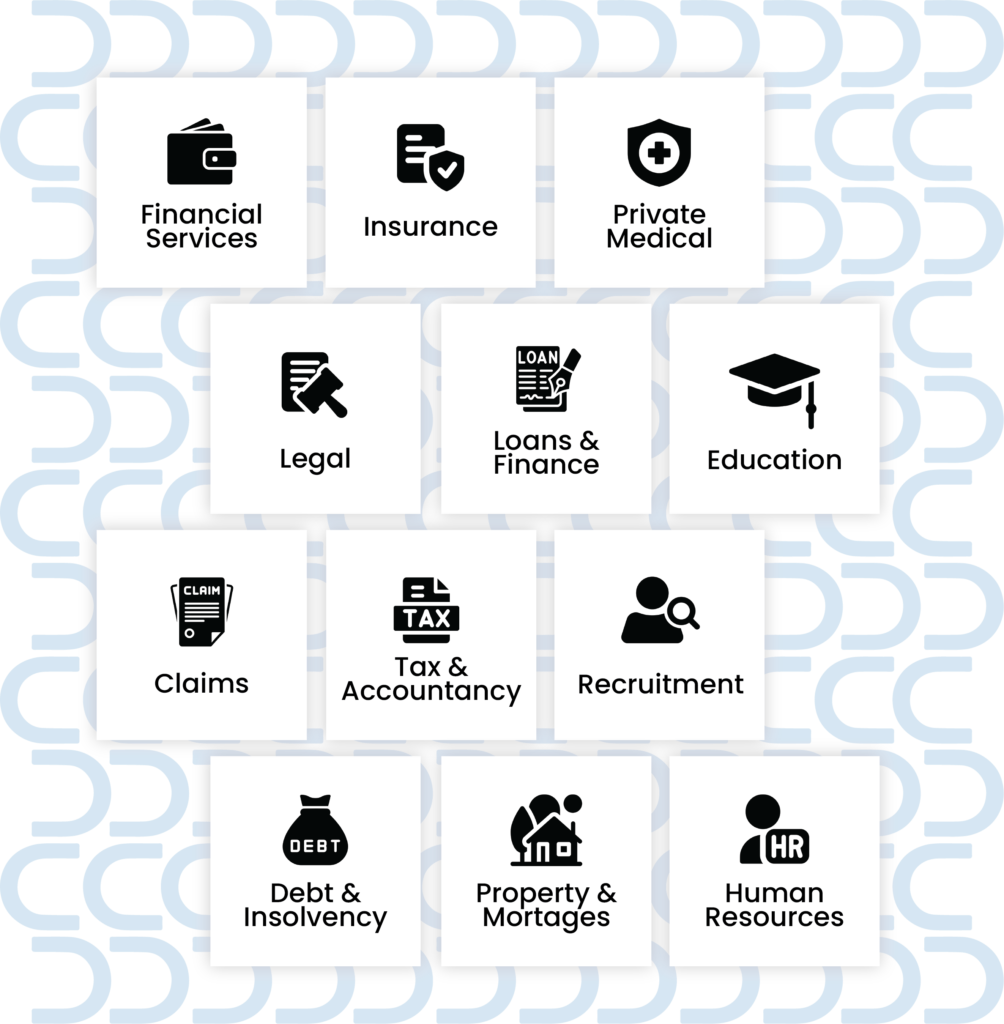

Sectors We Serve

FastDox.

An all-in-one platform.

Our all-in-one platform combines the power of 20 products into one customisable and brandable system.

We have helped businesses consolidate multiple cumbersome existing individual products into one centralised and succinct solution whilst streamlining processes, improving efficiency, reducing costs, and increasing conversions.

How does it work?

We're trusted by 100's of companies to

accelerate their business growth

1

Book a live

demonstration

Speak with one of our team and understand why FastDox is right for you and your business.

2

We’ll start the

onboarding

process

We’ll start building out

your software to your exacting specifications.

3

Move your new software

to a live environment

You’ll start benefiting straight away from our advanced CRM software.

Integration options to move

your data between web apps

- Use our API or powerful webhooks to link FastDox with many popular tools and services

- Receive leads directly from lead providers

- Connect seamlessly with 3,000+ external web apps and automate workflows between them with our Zapier integration

- Integrate with your external calendars

Other companies have already made the

switch to FastDox, why not join them?

FastDox is helping teams just like yours to manage

their leads and close more deals.

Just request a demo to get started.

- FastDox are committed to protecting your privacy